UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

o Preliminary Proxy Statement | | o Confidential, for Use of Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

o Definitive Additional Materials | | |

o Soliciting Material Pursuant to Rule 14a-12 | | |

Delta Apparel, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

______________________________________________________________________________________ _______________________________ | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| |

| o | Fee paid previously with preliminary materials |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

DELTA APPAREL, INC.

322 S. Main Street

Greenville, South Carolina 29601

Telephone (864) 232-5200

September 28, 201123, 2013

To Our Shareholders:

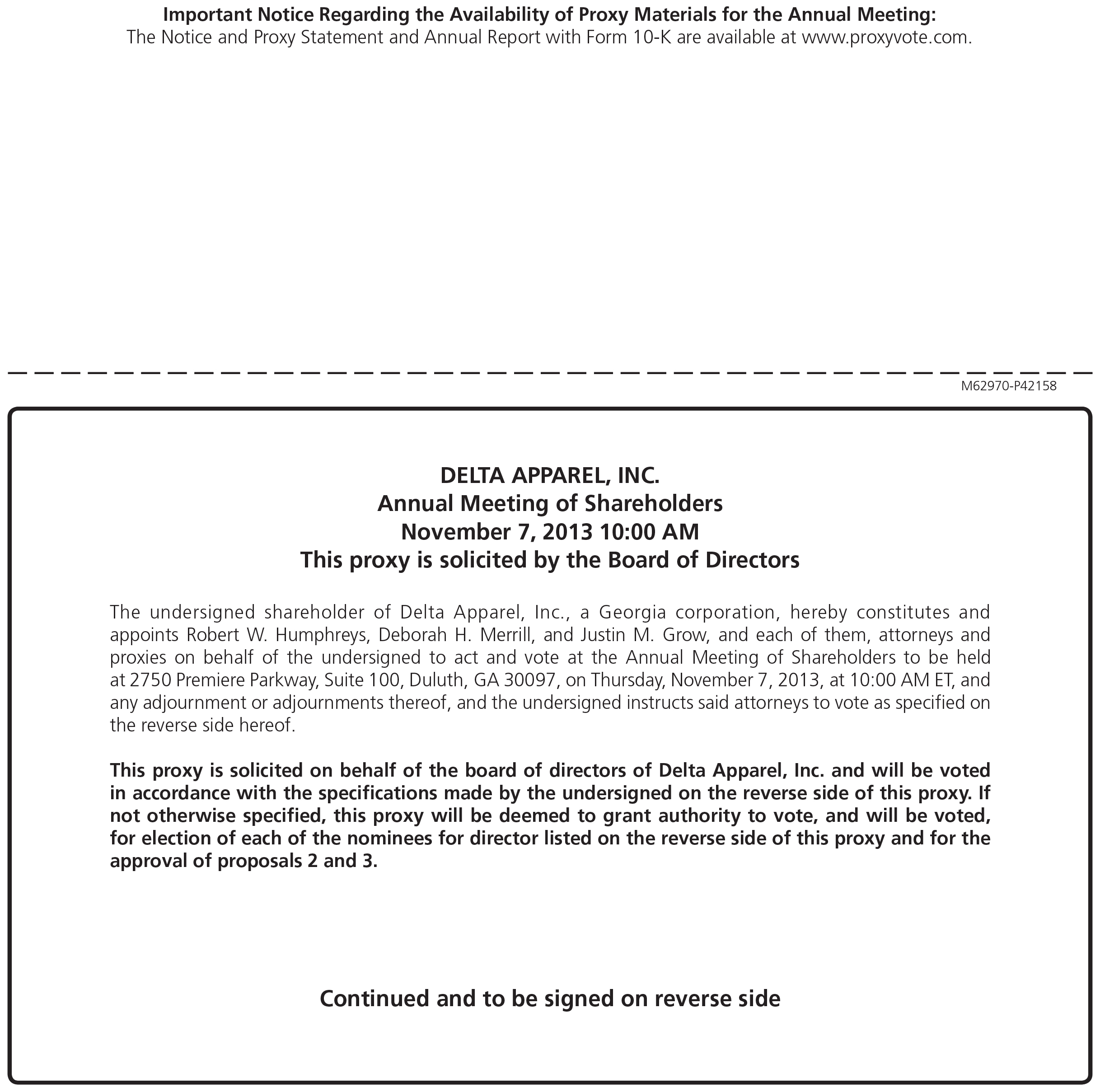

On behalf of the Board of Directors, Delta Apparel, Inc. invites you to attend the 20112013 Annual Meeting of the shareholders of Delta Apparel, Inc. on Thursday, November 10, 20117, 2013. The Annual Meeting will be held at our administrative offices located at 2750 Premiere Parkway, Suite 100, Duluth, Georgia. 30097. The Annual Meeting will begin at 10:00 a.m. local time.

The attached Proxy Statement describes the matters that we expect to act upon at the Annual Meeting. If you were a shareholder of record as of the close of businessSeptember 13, 2013, you are entitled to vote on September 16, 2011, you will find enclosed a proxy card and an envelope in which to return the card.these matters. Your vote is very important. Whether or notIf you planare unable to attend the meeting, please complete, sign, datevote by proxy over the Internet, by telephone or by completing the enclosed proxy card and return your enclosed proxysigning, dating and returning the card at your earliest convenience. ThisVoting over the Internet, by telephone or by written proxy card will ensure representation of your common sharesrepresentation at the Annual Meeting ifregardless of whether you attend in person. If you attend the Annual Meeting and desire to revoke your proxy and vote in person, you may do so. In any event, you are unableentitled to attend.revoke your proxy at any time before it is exercised.

We appreciate your continued support of Delta Apparel, Inc.

Sincerely,

Robert W. Humphreys

Chairman and Chief Executive Officer

DELTA APPAREL, INC.

322 S. Main Street

Greenville, South Carolina 29601

Telephone (864) 232-5200

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

November 10, 20117, 2013

It is my pleasure to invite you to attend the 20112013 Annual Meeting of the shareholders (the "Annual"2013 Annual Meeting") of Delta Apparel, Inc. ("Delta Apparel" or the(the "Company"), a Georgia corporation, on Thursday,, November 10, 20117, 2013, at 10:00 a.m. local time. The meeting will be held at our administrative offices located at 2750 Premiere Parkway, Suite 100, Duluth, Georgia 30097.

30097. At the 2013 Annual Meeting, shareholders will vote on the following matters, which are further described in the attached proxy statement (the "Proxy Statement"):

| |

| 1. | Election of the eight nominees named in the Proxy Statement to the Board of Directors to serve until the 2012Company's next annual meeting of shareholders or until their successors are duly elected and qualified; |

| |

| 2. | Re-approval of the Company's Short-Term Incentive Compensation Plan; |

| |

3. | Advisory vote on the compensation of the Company's named executive officers; |

| |

4.3. | Advisory vote on the frequency of future advisory votes on the compensation of the Company's named executive officers; |

| |

5. | Ratification of the appointment of Ernst & Young LLP to serve as the Company's independent registered public accounting firm ("independent auditors") for theour 2014 fiscal year ending June 30, 2012; year; and |

| |

6.4. | Action upon such other matters, if any, as may properly come before the meeting. |

All shareholders are cordially invited to attend the Annual Meeting. Shareholders of record at the closeas of business on September 16, 201113, 2013, are entitled to vote at the meeting.

By Order of the Board of Directors,

MarthaJustin M. WatsonGrow

Secretary

September 28, 201123, 2013

Greenville, South Carolina

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE MEETING, PLEASE EITHER VOTE VIA THE INTERNET, BY TELEPHONE, OR SIGN, DATE AND RETURN YOUR PROXY PROMPTLY IN THE ENCLOSED ENVELOPE.

* * * * * *

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on November 7, 2013: The Delta Apparel, Inc. Proxy Statement For The 2013 Annual Meeting of Shareholders and the Delta Apparel, Inc. 2013 Annual Report are Available at www.deltaapparelinc.com.

* * * * * *

TABLE OF CONTENTS

|

| |

| 1 |

| 5 |

| 9 |

| |

| |

| 11 |

| 12 |

| 13 |

| 19 |

| |

| 22 |

| 23 |

| 35 |

| 36 |

| 37 |

| 38 |

| 38 |

| 40 |

| 41 |

| |

| 42 |

| |

| 43 |

[This page intentionally left blank]

PROXY STATEMENT

Annual Meeting of Shareholders

November 10, 2011

ABOUT THE ANNUAL MEETING AND VOTING

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on November 10, 2011:

This Proxy Statement and proxy voting card are being mailed to holders of Delta Apparel, Inc. common stock beginning on or about September 23, 2013. On behalf of our Board of Directors, we are soliciting your proxy to vote your shares of the Company's common stock at our 2013 Annual Meeting and all adjournments or postponements of such meeting. We solicit proxies to provide all shareholders of record with an opportunity to vote on matters to be presented at the 2013 Annual Meeting. The information provided in this Proxy Statement is intended to assist you in voting your shares on these matters. This Proxy Statement and our 20112013 Annual Report are available at no charge on our internet website at www.deltaapparelinc.com.

QUESTIONS AND ANSWERS ABOUT THE 2013 ANNUAL MEETING

What is the purpose of the 2013 Annual Meeting?

At the 2013 Annual Meeting, theour shareholders will act upon the matters outlined in the Notice of Annual Meeting on the first page of Shareholders in this Proxy Statement, including the election of the eight nominees as directors, the re-approval of the Short-Term Incentive Compensation Plan, an advisory vote on the compensation of theour named executive officers, an advisory vote on the frequencyratification of the advisory vote on the compensation of the named executive officers, and the ratificationappointment of Ernst & Young LLP to serve as theour independent auditors. Such proxy may also be voted by the persons named in the proxy in their discretion uponregistered public accounting firm for our 2014 fiscal year, and such other business as may be properly brought before the meeting.2013 Annual Meeting. This Proxy Statement summarizes the information you need to know to vote at the 2013 Annual Meeting. This Proxy Statement and form of proxy were first mailed to shareholders on or about September 28, 2011.

Where will the 2013 Annual Meeting be held?

The 20112013 Annual Meeting will be held on Thursday, November 10, 20117, 2013, at 10:00 a.m. local time at our administrative offices located at 2750 Premiere Parkway, Suite 100, Duluth, Georgia 3009730097..

Who can attend the 2013 Annual Meeting?

All of our shareholders are invited to attend the 2013 Annual Meeting. Only Delta Apparel, Inc. shareholders as of the close of business on Friday, September 16, 201113, 2013 (the "Record Date"), may attendvote at the 2013 Annual Meeting.

Who is soliciting my vote?

The Company'sOur Board of Directors (the "Board") is soliciting your proxy to vote at the 2013 Annual Meeting.

What am I voting on?

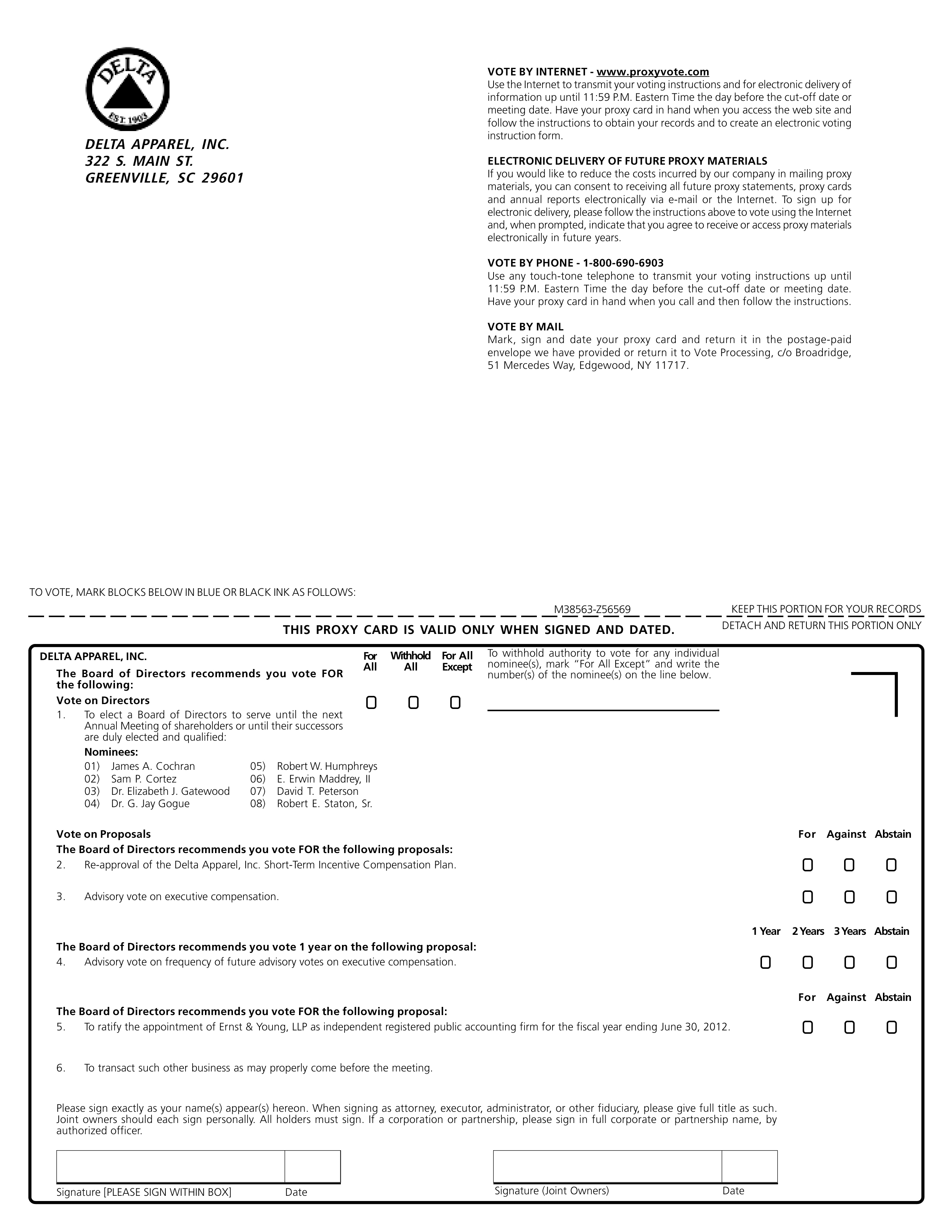

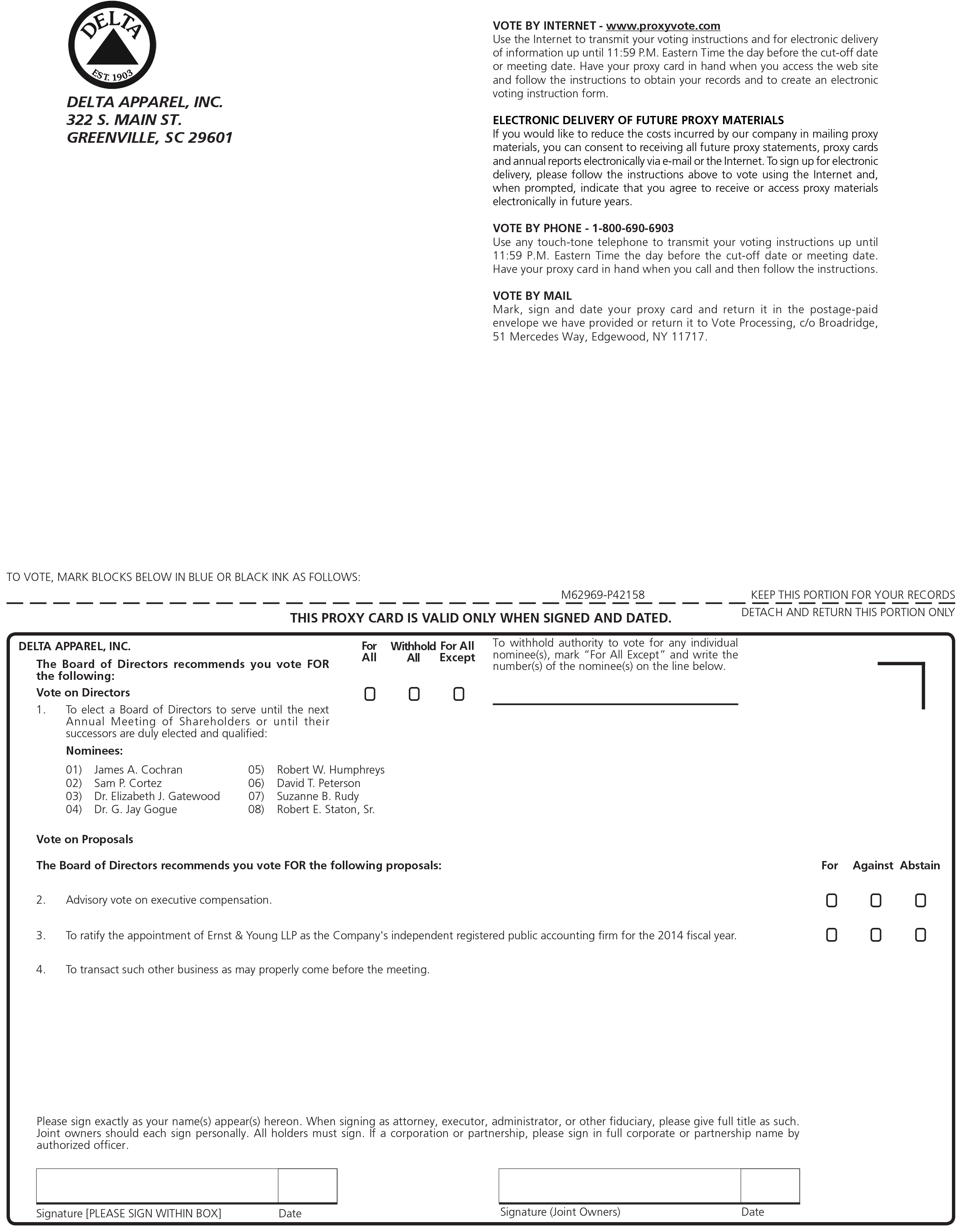

You are voting on fivethree proposals:

| |

| 1. | The election of the following eight nominees to the Board of Directors to serve until the 2012Company's next annual meeting of shareholders or until their successors are duly elected and qualified; |

|

| | | | |

| | James A. Cochran | | Robert W. Humphreys | |

| | Sam P. Cortez | | E. Erwin Maddrey, IIDavid T. Peterson | |

| | Dr. Elizabeth J. Gatewood | | David T. PetersonSuzanne B. Rudy | |

| | Dr. G. Jay Gogue | | Robert E. Staton, Sr. | |

| |

| 2. | The re-approvalAn advisory vote on the compensation of the Company's Short-Term Incentive Compensation Plan;our named executive officers as disclosed in this Proxy Statement; and |

| |

| 3. | Advisory vote on the compensation of the Company's named executive officers; |

| |

4. | Advisory vote on the frequency of future advisory votes on the compensation of the Company's named executive officers; and |

| |

5. | Ratification of the appointment of Ernst & Young LLP ("E&Y")to serve as our independent auditors.registered public accounting firm for our 2014 fiscal year. |

What are the voting recommendations of the Board?

The Board recommends the following votes:

| |

| 1. | FOR each of the eight director nominees to the Board ("Proposal No. 1"); |

| |

| 2. | FOR the re-approvalapproval of the Company's Short-Term Incentive Compensation Plancompensation of our named executive officers ("Proposal No. 2"); and |

| |

| 3. | FOR the approval of the compensation of the company's named executive officers ("Proposal No. 3"); |

| |

4. | FOR the approval of an annual shareholder advisory vote on the approval of the compensation of the Company's named executive officers ("Proposal No. 4"); and |

| |

5. | FOR the ratification of the appointment of E&YErnst & Young LLP to serve as our independent auditorsregistered public accounting firm for theour 2014 fiscal year ending June 30, 2012("Proposal No. 5"3").

|

Will any other matters be voted on?

The Board does not intend to present any other matters at the 2013 Annual Meeting and we do not know of any other matters that will be brought before the shareholders for a vote at the 2013 Annual Meeting. If any other matter is properly brought before the 2013

Annual Meeting, your signed proxy card gives authority to the persons named in the proxy to vote on such matters in their discretion and in accordance towith their best judgment.

Who is entitled to vote?

Only shareholdersHolders of record atour common stock as of the close of business on the Record Date, will be entitled toSeptember 13, 2013, may vote at the 2013 Annual Meeting.

Meeting, either in person or by proxy.

How many votes do I have?

You will have one vote for every share of Delta Apparel, Inc. common stock that you owned at the close of business on the Record Date. You do not have the right to cumulate your votes with respect to the election of any director.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Many shareholders hold their shares through a broker or bank rather than directly in their own names. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

Record. If your shares are registered directly in your name with the Company's transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent directly to you by the Company.

Beneficial Owner

Owner. If your shares are held in a stock brokerage account or by a bank, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your bank or broker, which is considered the shareholder of record of these shares. As the beneficial owner, you have the right to direct your bank or broker how to vote, and are also invited to attend the 2013 Annual Meeting. However, sinceif you are not the shareholder of record, you may not vote these shares in person at the 2013 Annual Meeting unless you bring with you a legal proxy from the shareholder of record. Your bank or broker has enclosedshould enclose a voting card for you to use for providing directions for how to vote your shares.

How do I vote?

If you are a shareholder of record, there are four ways to vote:

| |

| 1. | By internet at www.proxyvote.com; |

| |

| 2. | By toll-free telephone at 1-800-690-6903; |

| |

| 3. | By completing and mailing your proxy card; or |

| |

| 4. | By written ballot at the 2013 Annual Meeting. |

The internet and telephone voting procedures are designed to confirm your identity, to allow you to provide your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by internet or telephone, please follow the instructions that are printed on the enclosed proxy card. If you vote by internet or telephone, your vote must be received by 11:59 p.m. local time on November 9, 20116, 2013, the day before the 2013 Annual Meeting. Your shares will be voted as you indicate. If you sign and return your proxy card but you do not indicate your voting preferences, the proxies will vote your shares FOR Proposal No.Nos. 1, 2 3 and 5,3. Although we are not currently aware of any other matters that will be brought before the 2013 Annual Meeting, by signing and FOR an ANNUALreturning your proxy card you appoint the persons named as proxies as your representatives at the 2013 Annual Meeting. If a matter is raised for a vote on Proposal No. 4.at the 2013 Annual Meeting that is not included in these proxy materials, then the proxy holders will vote your shares in accordance with their best judgment.

If your shares are held in street name, you should follow the voting directions provided by your bank or broker. You may complete and mail a voting instruction card to your bank or broker or, in most cases, submit voting instructions by the internet or telephone to your bank or broker. If you provide specific voting instructions by mail, the internet or telephone, your shares should be voted by your bank or broker as you have directed. AS A RESULT OF THE NEW YORK STOCK EXCHANGE'SNYSE MKT'S RULES, YOUR BANK OR BROKER CANNOT VOTE WITH RESPECT TO PROPOSAL NOS. 1 2, 3 OR 42 UNLESS IT RECEIVES VOTING INSTRUCTIONS FROM YOU.

We will distribute written ballots at the 2013 Annual Meeting to any shareholder of record who wants to vote. If you hold your shares in street name, you must request a legal proxy from your bank or broker to vote in person at the 2013 Annual Meeting.

Can I change my vote or revoke my proxy?

Yes. If you are a shareholder of record, you can change your vote or revoke your proxy any time before the 2013 Annual Meeting by:

| |

| 1. | Entering a new vote by internet or telephone; |

| |

| 2. | Returning a later-dated proxy card; |

| |

| 3. | Sending written notice of revocation to MarthaJustin M. Watson, CorporateGrow, Secretary, at the Company's address of record, which is 322 S. Main Street, Greenville, South Carolina 29601; or |

| |

| 4. | Completing a written ballot at the 2013 Annual Meeting. |

Attendance at the 2013 Annual Meeting will not in and of itself constitute a revocation of a proxy.

If your shares are held in street name, you must follow the specific directions provided to you by your bank or broker to change or revoke any instructions you have already provided to your bank or broker.

How are votes counted?

Votes are counted by inspectors of election designated by the Corporateour Secretary.

Who pays for soliciting proxies?

We will pay for the cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying form of proxymaterials to our shareholders, as well as the cost of soliciting proxies relating to the meeting. In addition, we will reimburse banks and brokers for their reasonable charges and expenses in forwarding proxies and proxy materials to the beneficial owners of the shares held in street name. Delta Apparel'sOur officers, directors and employees may, without additional compensation, supplement these solicitations of proxies by telephone, facsimile, email and personal solicitation.

What is the quorum requirement of the 2013 Annual Meeting?

ATo conduct the 2013 Annual Meeting, a majority of the outstanding shares of Delta Apparelthe Company's common stock on the Record Date, representedentitled to vote must be present in person or by proxy at the Annual Meeting, constitutes a quorum for voting on proposals at the2013 Annual Meeting. This is referred to as a "quorum." If you vote, your shares will be partconsidered present at the 2013 Annual Meeting for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will be counted in determining the presence or absence of a quorum. On the Record Date, there were 8,514,6207,873,848 shares outstanding and 1,020970 shareholders of record. A majority of Delta Apparelthe Company's common stock, or 4,257,3103,936,925 shares, will constitute a quorum.

What are broker non-votes?

Broker non-votes occur when holders of record, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners by the date specified in the statement requesting voting instructions that has been provided by the bank or broker.

If that happens, the bank or broker may vote those shares only on matters as permitted by the NYSE MKT's rules and regulations. The New York Stock Exchange. The New York Stock ExchangeNYSE MKT prohibits banks and brokers from voting uninstructed shares in the election of directors and in matters related to executive compensation; accordingly, banks and brokers cannot vote with respect to Proposal Nos. 1 and 2 3 or 4 unless they receive voting instructions from the beneficial owners. Banks and brokers can vote on Proposal No. 5 even if they receive no voting instructions from beneficial owners. Broker non-votes will not affect the outcome of Proposal Nos. 1 2, 3, 4 and 52 being voted on at the 2013 Annual Meeting, assuming that a quorum is obtained.

What vote is required to approve each proposal?

Proposal No. 1: For the election of directors, the eight nominees for director will be elected if they receive an affirmative vote of a majority of the votes castshares present at the Annual Meetingmeeting or represented by proxy and entitled to vote for the election of directors.directors at the 2013 Annual Meeting. For purposes of the election of directors, the affirmative vote of a majority of votes castshares means that the number of shares voted "FOR" a director's election exceeds the number of votes withheld from a director's election. Votes cast exclude broker non-votes and abstentions, and therefore broker non-votes and abstentions will have no effect on the election of directors.

Proposal No. 2: Re-approval of the Company's Short-Term Incentive Compensation Plan requires that the number of votes cast "FOR" exceeds the number of votes cast against this proposal. Abstentions and broker non-votes will have no effect on the vote with respect to this proposal.

Proposal No. 3: For the advisory vote on the compensation of the Company'sour named executive officers, the vote is non-bindingnot binding on our Board of Directors or our Compensation Committee and, therefore, no specific vote is required to approve the proposal. However, the Board and the Compensation Committee will review the voting results and consider them in making future decisions about executive compensation.

Proposal No. 4: For the advisory vote on how often shareholders will be given the opportunity to vote on the compensation of

the Company's named executive officers, the vote is non-binding and, therefore, no specific vote is required to approve the proposal. However, the Board will consider the voting results in making the decision on the frequency3: Ratification of the shareholder vote on executive compensation, and the Company will report the Board's final intent in the Report on Form 8-K that reports the resultsappointment of the voting at the Annual Meeting.

Proposal No. 5: Ratification of E&YErnst & Young LLP to serve as the Company'sour independent auditorregistered public accounting firm requires that the number of votes cast "FOR" exceeds the number of votes cast against this proposal. Abstentions and broker non-votes will have no effect on the vote with respect to this proposal.proposal

Are the Company's proxy materials available on the internet?

Yes, this Proxy Statement and our 2013 Annual Report are available without charge on our website at www.deltaapparelinc.com.

Where can I find the voting results of the 2013 Annual Meeting?

We will announce the preliminary voting results at the 2013 Annual Meeting and will publish final results in a current report on Form 8-K filed with the SEC on or before November 16, 2011.11, 2013. This Form 8-K will be available without charge to shareholders upon written request to Investor Relations Department, Delta Apparel, Inc., 322 S. Main Street, Greenville, South Carolina 29601 or via the internet at www.deltaapparelinc.com.

What is the deadline for consideration of shareholder proposals or director nominations for the 2012next annual meeting of shareholders?

If you are a shareholder and you want to present a proposal at the 2012 annual meeting and have it included in the Company's proxy statement for that meeting, you must submit the proposal in writing at the Company's offices at 322 S. Main Street, Greenville, South Carolina 29601, Attention: Corporate Secretary, on or before May 31, 2012. Applicable Securities and Exchange Commission ("SEC"(“SEC”) rules and regulations govern the submission of shareholder proposals and the Company's consideration of them for inclusion in next year's proxy statement.

The Company has changed its fiscal year end such that the 2014 fiscal year will now end on September 27, 2014. The Company anticipates that its annual meeting following the 2014 fiscal year end will be on a date more than 30 days after the date of the 2013 annual meeting. As such, if you want to submit a proposal for inclusion in next year's proxy statement, proposals must be received by the Company a reasonable time before the Company begins to print and send its proxy materials. The Company currently expects it will print and send its proxy materials for the annual meeting following its 2014 fiscal year end on or about December 18, 2014. The Company believes a reasonable time for submissions to be received by the Company would be 120 days prior to printing and mailing of its proxy materials. This deadline will also apply in determining whether notice is timely for purposes of exercising discretionary authority with respect to proxies for purposes of Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended. If you want to present a proposal at the 2012fiscal year 2014 annual meeting of shareholders (but not have the proposal included in the Company's proxy statement) or to nominate a person for election as a director,, you must comply with the advance written notification and other requirements set forth in Delta Apparel's by-laws. You must giveour Bylaws, including having the proposal received by the Company at least 60 days'not later than July 9, 2014. In addition, nominations for the election of directors must comply with the advance written notice (or 120 days' advance written noticenotification and other requirements set forth in our Bylaws, which provide that in the caseevent the date of a director nomination),the annual meeting is changed by more than 30 days from the date of the previous years' annual meeting, then nominations must be received by the Company not later than 10 days after notice or public disclosure of the date of the annual meeting of shareholders for the election of directors. This notice will be included in our Notice of Annual Meeting and that notice must meet certain requirements described inProxy Statement for the by-laws.fiscal year 2014 annual meeting of shareholders.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Each of the Company’sour directors brings extensive management and leadership experience gained through his or her service to diverse businesses. The Board membersbusinesses and institutions. Our directors are committed to effectively oversee management’s performance, to act in the long-term best interests of shareholders and to maintain the highest standards of corporate governance.

Delta Apparel's bylawsOur Bylaws provide that the number of directors to be elected at any meeting of shareholders will be between two and fifteen, and will otherwise be determined by the Board of Directors. TheOur Board of Directors has determined that eight directors shall be nominated for election at the 2013 Annual Meeting.

The eight personsindividuals listed below are nominees for election as directors at the 2013 Annual Meeting to serve until our next Annual Meetingannual meeting of shareholders or until their successors are duly elected and qualified:

|

|

James A. Cochran |

Sam P. Cortez |

Dr. Elizabeth J. Gatewood |

Dr. G. Jay Gogue |

Robert W. Humphreys |

E. Erwin Maddrey, II |

David T. Peterson |

Robert E. Staton, Sr. |

Background information onqualified. Each of the nominees including somewas elected by the shareholders at our 2012 annual meeting of shareholders. Included in each nominee's biography below is a description of the qualifications, experience, attributes and skills of such nominee that led our Board to conclude that he or she is well qualified to serve as a member of the Board for our 2014 fiscal year and until the Company's next annual meeting of shareholders or until their selection, is set forth in "Corporate Governance - Board of Directors". Thesuccessors are duly elected and qualified.

Our Board's Corporate Governance Committee has affirmatively determined that with the exception of Robert W. Humphreys, Chairman and Chief Executive Officer, each directorof the nominees qualifies as "independent" under NYSE MKT corporate governance listing standards and also meets the Company's director qualification standards, which are described in the "Corporate Governance” section entitled “Director Nominations”.of this Proxy Statement. We believe that all of the nominees will be available and able to serve as directors.

Unless you vote “Withheld”“Withhold” with respect to a particular nominee or all nominees, the proxy holders will vote your shares “FOR” each of the nominees listed above.below. In the event that any nominee is not available or able to serve, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE EIGHT NOMINEES.

James A. Cochran

Director Since: 2008 Age: 66 Committees: Audit Committee; Compensation Committee

Mr. Cochran has served as Chief Financial Officer of Greenway Medical Technologies, Inc., a provider of software solutions for healthcare providers, since 2009. Previously, he was Senior Vice President responsible for Investor Relations and Corporate Strategies of TurboChef Technologies, Inc., a provider of equipment, technology and services for high-speed food preparation, and served in that capacity from 2007 until 2009. From 2003 until 2007, Mr. Cochran also served as Senior Vice President and Chief Financial Officer of TurboChef Technologies, Inc. He is a Certified Public Accountant. Mr. Cochran's broad and diverse professional knowledge base, including public accounting, mergers and acquisitions, investor relations, corporate strategy and financial management in public and private enterprises, provides the Board with valuable leadership and insight into these disciplines.

Sam P. Cortez

Director Since: 2010 Age: 50 Committees: Audit Committee; Compensation Committee

Mr. Cortez has been the principal of KCL Development LLC, a provider of corporate finance and advisory services, since 2003. Prior to 2003, he was employed in the investment banking industry, including Lehman Brothers, Donaldson Lufkin & Jenrette, Alex Brown & Sons, and Morgan Stanley International. Mr. Cortez serves as a director of Hancock Fabrics, Inc. and as chairman of its Management Review and Compensation Committee and is a member of its Audit and Governance Committees. He was formerly a director of World Waste Technologies, Inc., a development stage technology company, from 2005 to 2009, and served as chairman of its Audit Committee and as a member of its Compensation and Finance Committees. Mr. Cortez's experience includes mergers and acquisitions, strategy development, financing transactions and spin-offs. In addition to investment banking activities, he has served on boards and committees of private, public and not-for-profit organizations. Mr. Cortez recently earned the National Association of Corporate Directors' Board Leadership Fellow designation. His intimate knowledge of financial markets and strategic transactions brings a depth of knowledge in these areas to our Board.

Dr. Elizabeth J. Gatewood

Director Since: 2007 Age: 68 Committees: Audit Committee; Corporate Governance Committee

Dr. Elizabeth J. Gatewood is the Associate Director of the Wake Forest University Center for Enterprise Research and Education, a position to which she was appointed in July 2010. From July 2008 to July 2012, she served as Director of the Wake Forest University NSF Partners for Innovation Program. From 2004 until July 2010, she served as Director of the Office of Entrepreneurship & Liberal Arts at Wake Forest University. Previously, she served as the Jack M. Gill Chair of Entrepreneurship and Director of The Johnson Center for Entrepreneurship & Innovation at Indiana University from 1998 to 2004. Prior to her appointment at Indiana University, Dr. Gatewood was the Executive Director of the Gulf Coast Small Business Development Center Network at the University of Houston. Dr. Gatewood's academic background includes advanced business degrees in finance and business strategy. Her career has focused on entrepreneurship, growth strategies and small business education and development. She has extensive exposure to business development and models in international developing economies. Dr. Gatewood's perspectives on strategy, development and entrepreneurship bring unique insight to Board discussions.

Dr. G. Jay Gogue

Director Since: 2010 Age: 65 Committees: Audit Committee

Dr. Gogue is President of Auburn University, a position he has held since 2007. He served as President of the University of Houston and Chancellor of the University of Houston System from 2003 to 2007. Prior to serving at the University of Houston, he was President of New Mexico State University from 2000 to 2003 and Provost of Utah State University from 1995 to 2000. Dr. Gogue began his career in higher education administration in 1986 as Associate Director of the Office of University Research at Clemson University, where he also served as Vice President for research and Vice President and Vice Provost for agriculture and natural resources. Dr. Gogue has served as an accreditation reviewer for the Pacific Northwest Association of Schools and Colleges, Commission on Colleges. His leadership of large educational institutions has involved development of strategic plans, operating under difficult budgetary constraints and balancing the needs of diverse stakeholders including students, faculty, alumni and state government. Dr. Gogue's wealth of experience managing large and complex organizations provides our Board with valuable input and expertise.

Robert W. Humphreys

Director Since: 1999 Age: 56 Committees: None

Mr. Humphreys is the Chairman and Chief Executive Officer of Delta Apparel, Inc. He was named Chairman of our Board in June 2009. Mr. Humphreys previously served Delta Apparel, Inc. as President and Chief Executive Officer for more than 10 years. From April 1999 until December 1999 Mr. Humphreys served as President of the Delta Apparel division of Delta Woodside Industries, Inc. In May 1998, he was named Vice President of Finance and Assistant Secretary of Delta Woodside Industries, Inc. and served in that capacity until November 1999. From January 1987 to May 1998, Mr. Humphreys served as President of Stevcoknit Fabrics Company, the former knit fabrics division of a subsidiary of Delta Woodside Industries, Inc. Mr. Humphreys has over 25 years of experience in the textile and apparel industry, including senior leadership roles in operations and finance. Under his direction Delta Apparel has grown from a commodity t-shirt manufacturer to a diverse, branded apparel company. Mr. Humphreys' long history with the Company, combined with his leadership skills and operating experience, makes him particularly well-suited to be our Chairman and serve on our Board.

David T. Peterson

Director Since: 2003 Age: 62 Committees: Compensation Committee; Corporate Governance Committee

Mr. Peterson serves as Chairman Emeritus of The North Highland Company, a management and technology consulting services firm based in Atlanta, Georgia. Mr. Peterson founded The North Highland Company in 1992 and served as its Chairman and Chief Executive Officer until 2005 and as Chairman from 2005 until 2012. Mr. Peterson has more than 30 years of business experience that includes assisting large multinational enterprises, entrepreneurial businesses, medium-sized organizations, and non-profits in improving their businesses. He has consulted for a wide variety of industries ranging from aerospace and defense to medical equipment to telecommunications.Previously, he held management positions with Georgia-Pacific Corporation, a manufacturing company, and both Ernst & Young, LLP and Arthur Andersen & Co., which are accounting and consulting firms. He serves on a number of non-profit and for-profit boards and currently serves on the board of the Georgia Center for Non-Profits, and the Rotary Club of Buckhead. Mr. Peterson brings to our Board expertise in business development and improvement strategies.

Suzanne B. Rudy

Director Since: 2012 Age: 58 Committees: Audit Committee

Ms. Rudy is Vice President, Corporate Treasurer, Compliance Officer and Assistant Secretary of RF Micro Devices, Inc. (NASDAQ:RFMD), a publicly traded company and leading supplier of semiconductor solutions for the wireless communications market. In addition to her treasury and compliance duties, Ms. Rudy is a director for all twelve subsidiaries of RFMD. Prior to joining RF Micro Devices, Inc. in 1999, Ms. Rudy was the Controller for Precision Fabrics Group, Inc., a textile spin-off of the Fortune 500 Company, Burlington Industries. In addition, she spent six years as a CPA and Manager for BDO Seidman, LLP, an international CPA firm. From 2008 through 2010, she served as a director and chaired the Audit, Assets and Liability Committee of First National Bank United Corporation and also served on its Investment Committee. Ms. Rudy currently serves on the Board of Visitors for Guilford College. Ms. Rudy is currently a National Association of Corporate Directors Board Leadership Fellow, having completed the NACD's program for corporate directors. Ms. Rudy brings to our Board extensive expertise in public company financial, compliance and related strategic matters.

Robert E. Staton, Sr.

Director Since: 2009 Age: 67 Committees: Corporate Governance Committee; Compensation Committee

Until recently, Mr. Staton served as the Chief of Staff at Presbyterian College, a position he had held since July 2011. Mr. Staton currently provides business development consulting services to Coleman Lew + Associates, an executive search and leadership development firm. He served as Executive Vice President of External Relations at Presbyterian College from 2006 until July 2011. In 2002, Mr. Staton was named Chairman of the Board of Carolina National Bank until its acquisition by First National Bank of the South in 2008. From 1986 until 2002, Mr. Staton served as Chairman and Chief Executive Officer of Colonial Life, a publicly traded company primarily in the business of selling and servicing voluntary benefits programs. Mr. Staton served as a director of First National Bankshares and was a director of First National Bank of the South from 2008 until July 2010. Mr. Staton holds a Juris Doctor degree from the University of South Carolina School of Law. Mr. Staton has extensive professional experience in legal matters and senior executive positions with financial companies, as well as service as the chairman of a public company. Additionally, he has served on numerous boards and committees of public, private and civic, educational and other organizations. The knowledge and insight gained from this diverse experience contribute greatly to the Board.

[This page intentionally left blank]

PROPOSAL NO. 2

RE-APPROVAL OF THE COMPANY'S SHORT-TERM INCENTIVE COMPENSATION PLAN

On June 28, 2000, the Board of Directors adopted the Delta Apparel, Inc. Short-Term Incentive Compensation Plan (the “Short-Term Incentive Compensation Plan”) and the shareholders subsequently approved the Short-Term Incentive Compensation Plan. On November 8, 2007 the Short-Term Incentive Compensation Plan was re-approved by the shareholders. Under Section 162(m) of the Internal Revenue Code, the Short-Term Incentive Compensation Plan must be re-approved by the shareholders every five years for compensation paid pursuant to the plan to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code.

On September 15, 2011, the Board of Directors, upon recommendation from the Compensation Committee, re-approved the Short-Term Incentive Compensation Plan. No amendments were made to the Short-Term Incentive Compensation Plan.

The complete text of the Short-Term Incentive Compensation Plan is attached as Exhibit A to this Proxy Statement. The following description of the Short-Term Incentive Compensation Plan is a summary of certain terms and is qualified entirely by reference to Exhibit A.

Summary of the Short-Term Incentive Compensation Plan

Purpose. The purpose of the Short-Term Incentive Compensation Plan is to recognize and reward employees who contribute substantially to the achievement of the Company's short-term, strategic objectives that will enhance shareholder value.

Administration. The Short-Term Incentive Compensation Plan is administered by the Compensation Committee of the Company's Board of Directors. The Compensation Committee has broad authority to administer and interpret the Short-Term Incentive Compensation Plan and its provisions as it deems appropriate, subject to the express provisions of the Plan. All actions taken by the Compensation Committee under the Short-Term Incentive Compensation Plan shall be final, conclusive and binding.

Eligibility. All employees of the Company and its subsidiaries are potentially eligible to participate in the Short-Term Incentive Plan, however, only employees specifically selected by the Compensation Committee participate in the Plan for any performance period. There are approximately 490 employees, including all executive officers of the Company, currently eligible to participate in the Short-Term Incentive Compensation Plan.

Performance Objectives. Not later than 90 days after the commencement of a performance period (and in any event prior to the date when twenty-five percent (25%) of the performance period has elapsed), the Compensation Committee establishes in writing one or more performance goals for the performance period and the formula or method for determining the amount of compensation payable to the applicable participants if the performance goal is met. Performance goals are based on one or more of the following performance criteria: (i) total stockholder return; (ii) revenues, sales, net income, EBIT, EBITDA, stock price, and/or earnings per share; (iii) return on assets, net assets, and/or capital; (iv) return on stockholders' equity; debt/equity ratio; (v) working capital; (vi) safety; (vii) quality; (viii) our company's financial performance or the performance of our stock versus peers; (ix) cost reduction; (x) productivity; (xi) market mix; or (xii) economic value added, in each case determined in accordance with generally accepted accounting principles (GAAP). Performance goals may be based on either the performance of the Company over the performance period or, if the participant is employed by a subsidiary or division of the Company during the performance period, the performance during the performance period of such subsidiary or division. The Compensation Committee may establish different performance goals, and may base performance goals on different performance criteria, for different participants and/or different classes of participants. Each performance goal established must be an objective goal (meaning that a third party having knowledge of the relevant facts would be able to determine whether the performance goal has been met).

Payments. Prior to the commencement of the performance period, the Compensation Committee, in its sole discretion, designates the total bonus target amount for the performance period and approves the bonus target amounts for the executive officers participating in the Plan for the period. Regardless of the formula or method established by our Compensation Committee, no participant will be entitled to receive compensation pursuant to the Short-Term Incentive Compensation Plan in excess of $1,500,000 during any calendar year. No payment under the Short-Term Incentive Compensation Plan will be made to any participant unless and until the Compensation Committee certifies in writing that the relevant performance goal(s) and any other material preconditions to such payment were in fact satisfied. All payments under the Short-Term Incentive Compensation Plan will be in cash.

Termination of Employment. No participant will be entitled to any payment under the Short-Term Incentive Compensation Plan with respect to a performance period if the participant at any time during the performance period is not an employee of either the Company or one of its subsidiaries, except that, unless the Compensation Committee provides otherwise in writing, if the participant ceases to be an employee of either the Company or one of its subsidiaries during the performance period due to the participant's retirement (provided that the participant is at least age 62), death or permanent and total disability, the participant will be entitled

to a pro rata portion of the payment, if any, that the participant would have been entitled to had the participant remained employed until the end of the performance period by the Company or one of its subsidiaries, based on the portion of the performance period during which the participant was an employee.

Amendment and Termination. Generally, the Board may at any time, with or without notice, amend, suspend or terminate the Short-Term Incentive Compensation Plan, provided that no amendment that would require shareholder approval in order for payments under the Short-Term Incentive Compensation Plan to be deductible by the Company pursuant to Section 162(m) of the Internal Revenue Code will be effective without such shareholder approval.

Federal Income Tax Considerations. Generally, the Company will be entitled to a tax deduction for awards under the Short-Term Incentive Compensation Plan only to the extent that the executives recognize ordinary income from the award. Section 162(m) of the Internal Revenue Code contains special rules regarding the federal income tax deductibility of compensation paid to our Chief Executive Officer and to each of our other four other most highly compensated executive officers (other than our Chief Executive Officer). The general rule is that annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000 or it qualifies as “performance-based compensation” under Section 162(m). The Short-Term Incentive Compensation Plan has been designed to permit the Compensation Committee to grant awards, which qualify for deductibility under Section 162(m).

Program Benefits. Because the exact participants under the Short-Term Incentive Compensation Plan are determined on an annual basis, the precise number, name or positions of persons who will receive awards or the amount of such awards is not determinable at this time. However, as described above, the Short-Term Incentive Compensation Plan has been in place since 2000. The amounts payable pursuant to the Short-Term Incentive Compensation Plan relating to performance in the fiscal year ended July 2, 2011 for the following individuals and groups were as follows:

|

| | | | |

| Name and Position | | Amount |

| Robert W. Humphreys, Chairman and Chief Executive Officer | | $ | 835,625 |

|

| Deborah H. Merrill, Vice President, Chief Financial Officer and Treasurer | | 200,550 |

|

| Martha M. Watson, Vice President and Secretary | | 133,700 |

|

| Steven E. Cochran, President of Delta Activewear | | 653,735 |

|

| Kenneth D. Spires, President of M.J. Soffe, LLC | | 175,025 |

|

| All Current Executive Officers (5 people) | | 1,998,635 |

|

| Non-Executive Director Group | | — |

|

| Non-Executive Officer Employee Group | | 6,512,845 |

|

In addition, each of the executives contained in the above table have been selected as participants for fiscal year 2012 and it is anticipated that at least these executives will be selected as participants on an annual basis going forward. For fiscal year 2012, the Compensation Committee made changes to the performance goals. The performance goals for the awards based on the performance of the Company as a whole include 75% of the target amount based on return of capital employed (as defined as the Company's earnings before interest and taxes as a percentage of the twelve month average capital employed) and 25% of the target amount based on the three-year average earnings per share growth. This total is then adjusted for the sales growth or decline from the prior year sales. In addition to the performance goals based on the performance of the Company as a whole, Mr. Cochran and Mr. Spires receive a portion of their target value based on the performance of their particular business unit (Delta Activewear and M.J. Soffe, LLC, respectively). For fiscal year 2012, the performance goals for the Delta Activewear and M.J. Soffe, LLC business units are based one-third each on sales growth over the prior year, return on capital employed, and operating profit margin. For all awards in fiscal year 2012, whether based on the performance of the Company as a whole or based on the results of a business unit, there is no guaranteed payment amount. In addition, if performance goals are exceeded, there is a maximum bonus payout of 250% of the participant's target value.

A copy of the Short-Term Incentive Compensation Plan is attached to this Proxy Statement as Appendix A.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE COMPANY'S SHORT-TERM INCENTIVE COMPENSATION PLAN.

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") requires all publicly-traded companies to hold a shareholder advisory vote on the executive compensation of ourits named executive officers, (as listed herein under "Executive Officers"), otherwise known as a "Say-on-Pay". We ask vote. The Compensation Committee of our Board of Directors is committed to creating an executive compensation program that enables us to attract, retain, and motivate outstanding and diverse executives. Each year, the Compensation Committee reviews all of our executive compensation programs to ensure that they continue to reflect our commitment to align the objectives and rewards of our executive officers with the creation of value for our shareholders. The programs have been designed to reinforce our pay-for-performance philosophy by delivering total compensation that motivates and rewards short and long-term financial performance to maximize shareholder value. At the same time, we believe our compensation programs are appropriately measured and do not encourage excessive risk-taking by our executive team. Our Board believes that our philosophy and compensation practices strike the appropriate balance between utilizing responsible pay practices and effectively motivating our executives to dedicate themselves to the interests of our shareholders.

For these reasons, the Board requests that you approve the Company's executive compensation ofpolicies and practices for our named executive officers as described in this Proxy Statement, including the Compensation DisclosureDiscussion and Analysis, sectionthe executive compensation tables and the accompanying tables contained in this Proxy Statement.narrative discussions. Because your vote is advisory, it will not be binding on our Board, our Compensation Committee, or the Company, and we will not be required to take any action as a result of the outcome of the vote on this proposal. However, the Compensation Committee will carefully consider the voting results and take them into consideration when making future decisions regarding executive compensation arrangements.

Our Compensation Committee is committed to creating an executive compensation program that enables us to attract, retain, and motivate outstanding and diverse executives. Each year, the Compensation Committee reviews all of our executive compensation programs to ensure that they continue to reflect Delta Apparel's commitment to align the objectives and rewards of our executive officers with the creation of value for our shareholders. The programs have been designed to reinforce our pay-for-performance philosophy by delivering total compensation that motivates and rewards short and long-term financial performance to maximize shareholder value. At the same time, we believe our compensation programs do not encourage excessive risk-taking by our executive team. The Board believes that our philosophy and compensation practices strike the appropriate balance between utilizing responsible measured pay practices and effectively motivating our executives to dedicate themselves fully to value creation for our shareholders.

For these reasons, the Board requests that you approve the Company's executive compensation policies and practices for our named executive officers as described in this Proxy Statement pursuant to the SEC disclosure rules, including the Compensation Discussion and Analysis, the executive compensation tables and narrative discussions.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE COMPANY'S POLICIES AND PRACTICES ON EXECUTIVE COMPENSATION FOR OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL NO. 4

ADVISORY VOTE ON FREQUENCY OF FUTURE

ADVISORY VOTES ON EXECUTIVE COMPENSATION

The Dodd-Frank Act also requires all publicly-traded companies to provide shareholders the opportunity to cast an advisory vote on whether future advisory votes on the executive compensation of our named executive officers should occur every year, every two years, or every three years.

The Board believes that "Say-on-Pay" votes should be conducted every year so that shareholders may annually express their views on our executive compensation philosophy and practices. The option of one year, two years, or three years that receives the most votes by shareholders will be deemed the preferred frequency for the advisory vote on executive compensation that has been selected by the shareholders. Although this is an advisory vote and is non-binding, the Board and the Compensation Committee welcomes shareholder input on their preference as to the frequency of an advisory vote on executive compensation.

THE BOARD RECOMMENDS THAT YOU VOTE TO HOLD FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY "ONE" YEAR.

[This page intentionally left blank]

PROPOSAL NO. 53

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firmIn accordance with the requirements of our Audit Committee's charter, each year our Audit Committee evaluates and considers the qualifications, performance and independence of our external auditors. Based on its evaluation, the Audit Committee has appointed Ernst & Young LLP has been retained by our Audit Committee("E&Y") to serve as our independent registered public accounting firm for theour 2014 fiscal year ending June 30, 2012. The Audit Committee is responsible for selecting the Company’s independent auditors. Accordingly, shareholder approval is not required to appoint E&Y as our independent auditor for fiscal year 2012. Our Board believes, however, that submitting the appointment of E&Y to the shareholders for approval is a matter of good corporate governance.year. E&Y audited the Company’sour financial statements for fiscal year 20112013 and has served as our independent registered public accounting firm since 2001.

Although our Bylaws do not require that shareholders ratify the appointment of our independent registered public accounting firm, our Board believes that submitting the appointment of the independent registered public accounting firm for shareholder ratification at the 2013 Annual Meeting is appropriate from a corporate governance perspective. In the event that our shareholders do not ratify the appointment of E&Y, our Audit Committee will reconsider the appointment (but is not required to appoint a different independent registered public accounting firm). Even if the appointment is ratified, our Audit Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the fiscal year if our Audit Committee believes that such a change would be in the Company’s best interests and the best interests of our shareholders.

Representatives of E&Y will be present at the 2013 Annual Meeting and such representatives will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR 2014 FISCAL YEAR.

The following table presentssets forth the fees billed for professional audit services rendered by E&Y for the audit of our annual consolidated financial statements for the fiscal years ended July 2, 2011June 29, 2013, and July 3, 2010,June 30, 2012, and the fees billed for other services rendered by E&Y duringwith respect to those periods.

| | | | 2011 | | 2010 | 2013 | 2012 |

| Audit Fees | $ | 703,763 |

| | $ | 737,684 |

| $ | 711,590 |

| | $ | 712,800 |

| |

| Audit-Related Fees | 30,000 |

| | 13,500 |

| 7,500 |

| | 362,950 |

| |

| All Other Fees | 4,615 |

| | 1,765 |

| — |

| | 2,115 |

| |

| Total | $ | 738,378 |

| | $ | 752,949 |

| $ | 719,090 |

| | $ | 1,077,865 |

| (1) |

(1) At the time of the filing of our Proxy Statement for our 2012 fiscal year we had not received a final bill for professional services rendered by our independent registered public accounting firm for the fiscal year ended June 30, 2012. At that time, our independent registered public accounting firm estimated that we would be billed $1,208,850 for professional services rendered for the fiscal year ended June 30, 2012.

Audit Fees—Consists of fees billed for professional services rendered for the audit of our fiscal year 20112013 and fiscal year 20102012 consolidated annual financial statements, audit of internal control over financial reporting for fiscal years 20112013 and 20102012, review of the interim consolidated financial statements included in quarterly reports, and services that are normally provided by E&Y in connection with SEC filings.

Audit-Related Fees—Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements but are not reported under “Audit Fees.” For fiscal years 2011 and 2010,year 2012, $400,000 of such fees primarily related to E&Y’s performanceinvolvement in the independent investigation by the Audit Committee into the fiscal year-end financial closing processes utilized in our Activewear division, which was previously disclosed in connection with the September 12, 2012, Form 12b-25 we filed with the SEC, and $10,000 of opening balance sheet audits for TCX, LLC and Art Gun, LLC, respectively.such fees related to E&Y’s services provided in connection with the previously disclosed inventory write-down taken by the Company in the second quarter of fiscal year 2012.

All Other Fees—For fiscal yearsyear 2011 and 20102012, the fees were for an annual subscription for E&Y’s web-based accounting research service.

In the event that our shareholders fail to ratify the selection of E&Y,Audit Committee Pre-Approval Policies and Procedures

It is our Audit Committee will reconsider the selection (but is not requiredCommittee's policy to select a differentpre-approve all audit and permitted non-audit services proposed to be performed by our independent registered public accounting firm). Even if the selectionfirm. The pre-approval process is ratified, ourtypically as follows: Audit Committee pre-approval is sought at one of the Committee’s regularly scheduled meetings following the presentation of information at such meeting detailing the particular services proposed to be performed. The authority to pre-approve non-audit services may be delegated by the Audit Committee, pursuant to guidelines approved by the Committee, to one or more members of the Committee or management. The Committee has delegated to our Chief Financial Officer the authority to pre-approve non-audit services in an amount of up to $10,000.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee assists our Board of Directors in its discretion, may appoint a differentoversight of the integrity of the Company’s financial statements, compliance with legal and regulatory requirements, the qualifications, independence and performance of the independent accountants and the performance of the internal audit function. The Audit Committee is comprised entirely of independent directors who meet independence, experience and other qualification requirements of the NYSE MKT and the SEC. In addition, the Board of Directors has determined that Dr. G. Jay Gogue qualifies as an audit committee financial expert as defined by SEC rules and regulations.

Management is responsible for our financial reporting process, including our internal control over financial reporting, and for the preparation of the Company's consolidated financial statements, in accordance with generally accepted accounting principles. Our independent accountants are responsible for expressing an opinion on the financial statements and the effectiveness of the Company's internal control over financial reporting, based on an audit conducted in accordance with generally accepted auditing standards. The Audit Committee's responsibility is to oversee and review these processes. The Audit Committee relies, without independent verification, on the information provided to us and on the representations made by management and the independent registered public accounting firm atfirm.

The Audit Committee hereby reports as follows:

| |

| 1. | The Audit Committee appointed E&Y as the Company's independent registered public accounting firm for fiscal year 2013. |

| |

| 2. | The Audit Committee has reviewed and discussed the audited financial statements for the year ended June 29, 2013, and the internal controls over financial reporting as of June 29, 2013, with the Company’s management. |

| |

| 3. | The Audit Committee has discussed with E&Y the matters required to be discussed by Auditing Standard No. 61, Communication with Audit Committees. |

| |

| 4. | The Audit Committee has received the written disclosures and the letter from E&Y required pursuant to Rule 3526 of the Public Company Accounting Oversight Board, Communication with Audit Committees Concerning Independence, and has discussed with E&Y its independence from the Company. |

In determining E&Y’s independence, the Committee also considered whether the provision of any time duringof the non-audit services provided to the Company is compatible with maintaining their independence. The Committee received regular updates on E&Y’s fees and the scope of audit and non-audit services it provided. All such services were provided consistent with applicable rules and our pre-approval policies and procedures.

Based on our discussions with management, our internal auditors and E&Y, and our review of the audited financial statements, including the representations of management and E&Y with respect thereto, and subject in all cases to the limitations on our role and responsibilities referred to above and set forth in our charter, the Audit Committee recommended to the Board of Directors that the Company's audited consolidated financial statements for the fiscal year if our Audit Committee believes that such a change wouldended June 29, 2013, be included in the Company’s best interests and the best interests of our shareholders.Company's Annual Report on Form 10-K.

Representatives of E&Y will be present at the Annual Meeting and such representatives will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2012.AUDIT COMMITTEE:

Dr. G. Jay Gogue (Chairperson)

James A. Cochran

Sam P. Cortez

Dr. Elizabeth J. Gatewood

Suzanne B. Rudy

CORPORATE GOVERNANCE

Overview

Our Company believesWe believe that good corporate governance practices not only reflect our values andas a Company but also support our strong strategic growth and financial performance. Each committee of theour Board has a charter, which can be found on the "Corporate Governance" page of our website located at www.deltaapparelinc.com, that spells out the committee's assigned roles and responsibilities assigned to it by the Board.responsibilities. In addition, theour Board has established policies and procedures that address matters such as chief executive officer and key management succession planning, transactions with related persons, risk oversight, communications with the Board by shareholders and other interested parties, as well as the independence and qualifications of our directors. The following pages provide insightsinsight into how theour Board has implemented these policies and procedures to benefit our Company and our shareholders.

Director Independence

Our Board evaluates the independence of each director in accordance with applicable laws and regulations and the listing standards of the NYSE Amex Stock Exchange.MKT. Generally, an “independent director” is a director who is not also an officer or employee of the Company or any parent or subsidiary of the Company. In addition, no director qualifies as independent unless the Board affirmatively determines that the director does not have a material relationship with the Company that would interfere with the exercise of independent judgment. Our Board has reviewed the relationships between each member of the Board and the Company and determined that with the exception of Robert W. Humphreys, Chairman and Chief Executive Officer, each of our current directors and each individual standing for election is “independent” as required by applicable laws and meets the applicable NYSE MKT independence requirements of the NYSE Amex Company Guide.requirements. Each director is required to keep the Board fully and promptly informed as toof any developments that might affect his or her independence.independence and the Board will regularly review the continuing independence of the directors.

Code of Ethics and Business Conduct

We maintain a code of ethics and business conduct known as our Ethics Policy Statement that applies to all employees, officers and directors, including, but not limited to, our Chief Executive Officer and our Chief Financial Officer (who is also our principal accounting officer). Our Ethics Policy Statement covers topics such as conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, confidentiality, anti-corruption, compliance procedures and employee complaint and reporting procedures. Our Ethics Policy Statement is available without charge on the "Corporate Governance" page of our website located at www.deltaapparelinc.com. Any amendments or waivers to provisions of our Ethics Policy Statement that are applicable to our Chief Executive Officer, Chief Financial Officer, Controller or persons performing similar functions will be posted on our website. There were no waivers of the provisions of our Ethics Policy Statement for our Chief Executive Officer, Chief Financial Officer or any director, senior financial officer or other executive officer during fiscal year 2013.

Board Leadership Structure

The Company’sOur governance documents provide the Board with flexibility to select the appropriate leadership structure offor the Company. TheOur Board of Directors does not have a policy on whether or not the roles of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee. Theemployee of the Company. Our Board of Directors believes that it should be free to make a choice from time to time based on circumstances existing at that time to determine the leadership structure that is in the best interests of the Company and our shareholders. shareholders based on the particular circumstances in effect from time to time.

During fiscal year 20112013, Robert W. Humphreys served as the Chairman of theour Board and as Chief Executive Officer. Mr. Humphreys is the director most familiar with our business and industry, and possesses detailedintimate knowledge of the issues, opportunities and challenges facing us and our business. TheOur Board of Directors believes thethis combined position is in the current best interest of our Company, as it makes the best use of Mr. Humphreys’ skillsextensive experience and experience withqualifications within the Companyapparel industry and in-depth knowledge of our markets, helps provide strong, unified leadership and direction on important strategic initiatives to both management and the Board, and leverages the insight gained from the combined role to ensuremost effectively lead our Company. We believe that they act with a common purpose. The Company believes that itsour overall corporate governance policies and practices, combined with the presence of a Lead Independent Director, adequately addresses any governance concerns raised by the dual Chairman and Chief Executive Officer role.

Lead Independent Director

During fiscal year 20112013, Mr. MaddreyRobert E. Staton, Sr. served as the Lead Independent Director. Theour Lead Independent Director, hasand Mr. Staton is expected to serve as our Lead Independent Director throughout fiscal year 2014. Our Lead Independent Director is appointed by the independent members of our Board, generally serves for a term of at least one year, and is empowered to carry out a number of responsibilities, including presidingcritical responsibilities. In addition to serving as a liaison between the Chairman and the independent directors, our Lead Independent Director presides at executive sessions of the Board acting as liaison betweenand at meetings at which our Chairman is not present, including any executive sessions of the Chairmanindependent directors, approves meeting schedules to ensure there is sufficient time for discussion of agenda items, advises on and the other Directors, and advising with respect to the schedule, agendaapproves meeting agendas and information provided for Board meetings.meetings and meetings of independent directors, calls meetings of the independent directors as appropriate, and is available for direct communication with shareholders. The Lead Independent Director, along with theour other non-employee directors, also provides independent oversight of management and the Company’s strategy.

Board of Directors

During the fiscal year ended July 2, 2011, the Board was composed of nine independent directors and Robert W. Humphreys, Chairman of the Board and Chief Executive Officer. Two of the directors, Mr. William F. Garrett and Dr. A. Max Lennon are retiring from the Board and will not be standing for re-election. The following table, listed in alphabetical order, sets forth the names of the nominees for director and their respective ages, years as director and positions with the Company.

|

| | | | | | |

| Directors' Name | | Age | | Director Since | | Position |

| James A. Cochran | | 64 | | 2008 | | Director |

| Sam P. Cortez | | 48 | | 2010 | | Director |

| Dr. Elizabeth J. Gatewood | | 66 | | 2007 | | Director |

| Dr. G. Jay Gogue | | 64 | | 2010 | | Director |

| Robert W. Humphreys | | 54 | | 1999 | | Chairman and CEO |

| E. Erwin Maddrey, II | | 70 | | 1999 | | Director |

| David T. Peterson | | 60 | | 2003 | | Director |

| Robert E. Staton | | 65 | | 2009 | | Director |

Each of the Company's directors brings extensive management and leadership experience gained through his or her service to diverse businesses. Below is a description of the backgrounds of our directors, along with some of the attributes that led to their selection as nominee for the Board for the fiscal year ending June 30, 2012.

James A. Cochran. James A. Cochran is Chief Financial Officer of Greenway Medical Technologies, Inc., a business providing software solutions for healthcare providers, a position he has held since 2009. Previously, he served as Senior Vice President responsible for Investor Relations and Corporate Strategies of TurboChef Technologies, Inc., a provider of equipment, technology and services for high-speed food preparation, and served in that capacity from 2007 until January 2009. From 2003 until 2007, Mr. Cochran also served as Senior Vice President and Chief Financial Officer of TurboChef Technologies, Inc. Mr. Cochran’s professional experience includes public accounting, mergers and acquisitions, investor relations, corporate strategy and financial management in public and private enterprises. This broad and diverse knowledge base provides the Board with valuable insight in a number of disciplines.

Sam P. Cortez. Sam P. Cortez has been the principal of KCL Development LLC, a provider of corporate finance and advisory services, since 2003. Prior to 2003, he was employed in the investment banking industry, including Lehman Brothers, Donaldson Lufkin & Jenrette, Alex Brown & Sons, and Morgan Stanley International. Mr. Cortez serves as a director of Hancock Fabrics, Inc. and as chairperson of its Management Review and Compensation Committee and on its Audit Committee. He was formerly a director of World Waste Technologies, Inc., a development stage technology company, from 2005 to 2009. Mr. Cortez’s experience includes mergers and acquisitions, strategy development, financing transactions and spin-offs. In addition to investment banking activities, he has served on boards and committees of private, public and not-for-profit organizations. His intimate knowledge of financial markets and strategic transactions brings a depth of knowledge in these areas as we continue to grow the Company.

Dr. Elizabeth J. Gatewood. Dr. Elizabeth J. Gatewood is the Director of the Wake Forest University National Science Foundation Partners for Innovation Program, a position she began in July 2010. From 2004 until July 2010, she served as Director of the University Office of Entrepreneurship & Liberal Arts at Wake Forest University. Previously, she served as the Jack M. Gill Chair of Entrepreneurship and Director of The Johnson Center for Entrepreneurship & Innovation at Indiana University from 1998 to 2004. Prior to her appointment at Indiana University, Dr. Gatewood was the Executive Director of the Gulf Coast Small Business Development Center Network at the University of Houston. Dr. Gatewood’s academic background includes advanced business degrees in finance and business strategy. Her career has focused on entrepreneurship, growth strategies and small business education and development. She has extensive exposure to business development and models in international developing economies. Her perspectives on strategy, development and entrepreneurship bring unique insight to board discussions.

Dr. G. Jay Gogue. Dr. G. Jay Gogue is President of Auburn University, a position he has held since 2007. From 2003 to 2007, he served as President of the University of Houston and Chancellor of the University of Houston System. Prior to serving at the University of Houston, he was President of New Mexico State University from 2000 to 2003 and Provost of Utah State University from 1995 to 2000. Dr. Gogue began his career in higher education administration in 1986 as Associate Director of the Office of University Research at Clemson University, where he also served as Vice President for research and Vice President/Vice Provost for agriculture and natural resources. Dr. Gogue has served as an accreditation reviewer for the Pacific Northwest Association of Schools and Colleges, Commission on Colleges. Dr. Gogue has experience leading large educational institutions. This leadership has involved development of strategic plans, operating under difficult budgetary constraints and balancing the needs of diverse stakeholders including students, faculty, alumni and state government. We believe his leadership experience serves the Board well.

Robert W. Humphreys.Robert W. Humphreys currently serves as President and Chief Executive Officer of Delta Apparel, Inc. and has served in this capacity since December 1999. Mr. Humphreys has also been serving as Chairman of the Board of Directors of the Company since June 2009. Mr. Humphreys served as President of the Delta Apparel division of Delta Woodside Industries, Inc. from April 1999 until December 1999. Previously, he served as Vice President-Finance and Assistant Secretary of Delta Woodside Industries, Inc. from May 1998 to November 1999. From January 1987 to May 1998, Mr. Humphreys was President of Stevcoknit Fabrics Company, the former knit fabrics division of a subsidiary of Delta Woodside Industries, Inc. Mr. Humphreys has over 25 years of experience in the textile and apparel industry, including senior leadership roles in operations and finance, as well as serving as the Company’s President and Chief Executive Officer for over 10 years. He has provided strong leadership as the Company has grown from a catalog tee shirt company to a diverse active apparel company. His deep knowledge of Delta Apparel and of the industry provides the Board a resource of great value.

E. Erwin Maddrey, II. E. Erwin Maddrey, II is currently the President of Maddrey & Associates, which engages in the business of investing and providing consulting services, and has held this position since 2000. He served as President and Chief Executive Officer of Delta Woodside Industries, Inc., a textile manufacturing company, from its founding in 1984 until June 2000. Mr. Maddrey currently serves as a director of KEMET Corporation and served as a director of Delta Woodside Industries, Inc. until 2007. Mr. Maddrey has been a director since 1999 and is a member of the Audit Committee and Corporate Governance Committee in 2011. Mr. Maddrey has experience as a President and CEO of a public textile and apparel company, as well as

service on boards and committees of a variety of public and not for profit organizations. The deep and broad knowledge provided by this experience, coupled with his extensive financial knowledge, provide significant value to the Board.